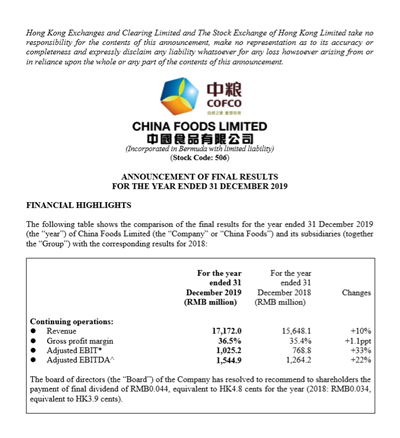

On March 24, China Foods Limited (the “Company” or “China Foods”, Stock Code: HK0506), the holding company of COFCO Cola-Cola Beverages Limited (CBL for short), announces its final results for the year ended 31 December 2019. In 2019, China Foods achieved growth of 9.7% in revenue to RMB17, 172 million and 30.2% in net profit to 418 million compared with last year with improvement of gross margin of 1.1% to 36.5%.

Notably, it is the first time for adjust EBIT to exceed RMB 1 billion since M&A. All 9 newly franchised plants ran profitably and their profitability achieved almost the same level as the original 10 plants after the completion of refranchising in 2017, which benefits from powerful resources integration. Meanwhile, the company focuses on capital expenditure and the management of cash flows to reduce financial costs further so that the operating profit margin is higher than last year.

Mr. Lijun Qing, managing director of China Foods Ltd., stated that China Foods kept fast growth by optimizing product portfolio and enriching retail channels to step into the high-quality development of specialized platform. Besides, he pointed that China Foods would bring higher investment returns to shareholders by the continuous enhancement of profitability and market share in the future.

Some industry analyst indicated that China Foods reached ‘double higher growth’ in the past two years attributed to its good performance as specialized beverage platform, that is, ‘growth in revenue is higher than volume, and increase in profit is higher than revenue’. The improvement of profitability and operation efficiency deriving from product mix and resources integration, which shows strong endogenic driver to investors.

All newly acquired bottling plants come into a new era of profitability

All 9 newly franchised plants ran profitably and their profitability achieved almost the same level as the original 10 plants after the completion of refranchising in 2017.

CBL completed the refranchising project of 9 bottling plants, such as Heilongjiang, Jilin, Liaoning, Shanxi, Shaanxi, Sichuan and Chongqing. The number of bottling plants increased to 19. CBL made these 9 bottling plants profitable gradually by improved management, capacity optimization and resource integration.

In term of warehouse and delivery, China Foods continuously improve logistics efficiency and warehouse management to reduce logistics cost and enhance delivery efficiency by update and promotion of management information system. Besides, Implement standardized logistics operation and balanced operation to improve efficiency and capacity. As a result, logistics cost per unit case decreased compared with last year in 2019.

During the year, China Foods optimized supplier management through integrating supplier resources, and improving supplier concentration so that cost of raw materials fell down further.

Furthermore, China Foods continued to expand channels and the number of customers as well as adjust customer structure. During the year, the number of customers served increased by more than 40,000, mainly from Modern Trade channels (MT) (+17,000) and catering channels (+63,000). Besides, China Foods collaborated with E-commerce channel by the vigorous promoting new products, high-margin products and diversified marketing strategies to drive consumption. Consequently, annual revenue increased by 50%. Rapid development of new retail channels and other segmented channels, like CVS, minimarket, assisted in the achievement of double-digit growth of revenue.

Double-digit development of COFCO Coca-Cola Beverage Ltd.

During the year, China Foods continued to maintain growth in revenue, sales volume, net profit, representing an increase of 9.7%, 6.1% and 30.2% compared with last year. The growth rate of net profit was higher than revenue, and the growth rate of revenue was higher than volume. Some analyst deemed that product mix optimization and increase in price and volume led to the improvement of profitability dramatically.

In 2019, China Foods led in its franchised regions, especially the value share of sparkling and juice higher than competitors, beneficially from product mix optimization.

During the year, China Foods accelerated innovation by promoting new product expanding, like RTD tea, coffee, and sports drinks. The year ended 31 December 2019, there are 6 categories and 17 SKUs launched and new products contributed more than 8% of the revenue.

Notably, 4 hot drink products debuted at CBL in the winter of 2019 and gained consumers’ love, involving 3 brands and 4 favors like GEORGIA latte coffee, GEORGIA bubble tea, Minute Maid Honey Yuzu and Authentic Teahouse Pu’er tea.

During the year, China Foods drove the growth of high-margin products. Gross margin was enhanced gradually, and increased by 1.1% with the rise in ASP and raw material cost control. The sparkling category was annul ’popular category‘, especially sugar-free and fiber series achieved 18% growth in volume; water category developed further and revenue grew fast with continuous market investment of 2-yuan Chuanyue.

It is demonstrated by data that sparkling and package water grew higher than the average of NARTD. The market share by value for sparkling drinks in operating regions increased by 0.6 percentage point, and the market share continued to be maintained at over 60%, surpassing its main competitors’ products further.

Teach villager how to feed themselves and assisted in targeted poverty alleviation

China Foods implemented social responsibilities actively and blew the horn of poverty alleviation. By the end of 2019, the company invested 19,151 persons, 76,493 labor-hours and RMB 11.96 million, which represented ‘China’s confidence’ in poverty alleviation.

During the year, CBL contributed RMB 5 million to poverty alleviation projects in Shiqu County, and purchased agricultural products of approximately RMB 2.034 million in value. Besides, the company helped to sell approximately RMB 827,900 worth of agricultural products, and trained 72 basic-level cadres and 23 technicians. As of the year-end, CBL helped raise nine villages out of poverty, benefiting 2,134 impoverished persons in total.

In 2019, COFCO Coca-Cola launched featured alleviation projects in 17 of the provinces in which it operates. With the aim of helping to overcome poverty through skill-, employment- and education-based methods, there were a total of 54 specific poverty alleviation activities, which benefited 56,273 persons, with the projects directly yielding RMB 161,450 in economic benefits.

Besides, COFCO Coca-Cola Beverage Ltd. launched another public welfare project, namely, Clean Drinking Water in 24 Hours rescue mechanism, aiming at solving drinking water where it is vitally needed. In 2019, COFCO Coca-Cola Beverage Ltd., responded to the Clean Water in 24 Hours rescue mechanism on 15 occasions, providing more than 600,000 bottles of water to victims and rescuers in disaster-stricken areas.

During the COVID-19 outbreak, Clean Drinking Water in 24 Hours rescue mechanism restarted. By the end of March 2020, COFCO Coca-Cola Beverage Ltd. donated over 250, 000 bottles of water among Wuhan and other cities to guarantee safe water supply.

In 2019, China Foods showed strong growth momentum and operation efficiency and profitability were improved significantly. Mr. Qing Lijun, managing director of China Foods, believes that although fluctuation affected by epidemic outbreak in the short-term, it would not have an impact on long-term development with a good start in 2020. Mr. Qing said ‘We are confident to maintain business development steadily, and to create greater value to consumers, staff and shareholders’.